총 400페이지

4페이지 본문시작

4_2021년한국정부회계학회·한국회계정보학회하계학술대회발표논문집

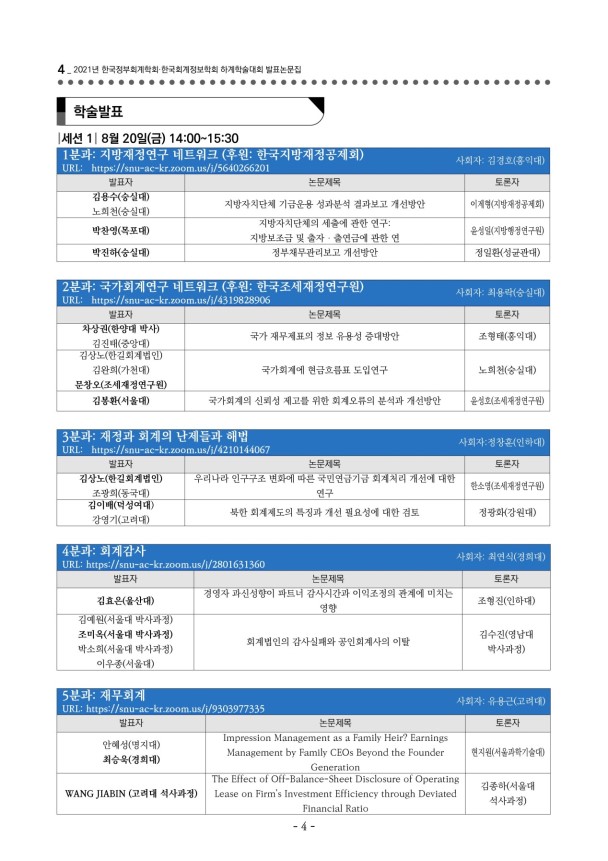

학술발표

!세션1!8월20일(금)14:00~15:30

1분과: 지방재정연구 네트워크 (후원: 한국지방재정공제회)

사회자: 김경호(홍익대)

URL: https://snu-ac-kr.zoom.us/j/5640266201

발표자

논문제목

토론자

김용수(숭실대)

지방자치단체 기금운용 성과분석 결과보고 개선방안

이계형(지방재정공제회)

노희천(숭실대)

지방자치단체의 세출에 관한 연구:

박찬영(목포대)

윤성일(지방행정연구원)

지방보조금 및 출자·출연금에 관한 연

박진하(숭실대)

정부채무관리보고 개선방안

정일환(성균관대)

2분과: 국가회계연구 네트워크 (후원: 한국조세재정연구원)

사회자: 최용락(숭실대)

URL: https://snu-ac-kr.zoom.us/j/4319828906

발표자

논문제목

토론자

차상권(한양대 박사)

국가 재무제표의 정보 유용성 증대방안

조형태(홍익대)

김진태(중앙대)

김상노(한길회계법인)

김완희(가천대)

국가회계에 현금흐름표 도입연구

노희천(숭실대)

문창오(조세재정연구원)

김봉환(서울대)

국가회계의 신뢰성 제고를 위한 회계오류의 분석과 개선방안

윤성호(조세재정연구원)

3분과: 재정과 회계의 난제들과 해법

사회자:정창훈(인하대)

URL: https://snu-ac-kr.zoom.us/j/4210144067

발표자

논문제목

토론자

김상노(한길회계법인)

우리나라 인구구조 변화에 따른 국민연금기금 회계처리 개선에 대한

한소영(조세재정연구원)

조광희(동국대)

연구

김이배(덕성여대)

북한 회계제도의 특징과 개선 필요성에 대한 검토

정광화(강원대)

강영기(고려대)

4분과: 회계감사

사회자: 최연식(경희대)

URL: https://snu-ac-kr.zoom.us/j/2801631360

발표자

논문제목

토론자

경영자 과신성향이 파트너 감사시간과 이익조정의 관계에 미치는

김효은(울산대)

조형진(인하대)

영향

김예원(서울대 박사과정)

조미옥(서울대 박사과정)

김수진(영남대

회계법인의 감사실패와 공인회계사의 이탈

박소희(서울대 박사과정)

박사과정)

이우종(서울대)

5분과: 재무회계

사회자: 유용근(고려대)

URL: https://snu-ac-kr.zoom.us/j/9303977335

발표자

논문제목

토론자

Impression Management as a Family Heir? Earnings

안혜성(명지대)

Management by Family CEOs Beyond the Founder

현지원(서울과학기술대)

최승욱(경희대)

Generation

The Effect of Off-Balance-Sheet Disclosure of Operating

김종하(서울대

WANG JIABIN (고려대 석사과정)

Lease on Firm’s Investment Efficiency through Deviated

석사과정)

Financial Ratio

- 4 -

학술발표

!세션1!8월20일(금)14:00~15:30

1분과: 지방재정연구 네트워크 (후원: 한국지방재정공제회)

사회자: 김경호(홍익대)

URL: https://snu-ac-kr.zoom.us/j/5640266201

발표자

논문제목

토론자

김용수(숭실대)

지방자치단체 기금운용 성과분석 결과보고 개선방안

이계형(지방재정공제회)

노희천(숭실대)

지방자치단체의 세출에 관한 연구:

박찬영(목포대)

윤성일(지방행정연구원)

지방보조금 및 출자·출연금에 관한 연

박진하(숭실대)

정부채무관리보고 개선방안

정일환(성균관대)

2분과: 국가회계연구 네트워크 (후원: 한국조세재정연구원)

사회자: 최용락(숭실대)

URL: https://snu-ac-kr.zoom.us/j/4319828906

발표자

논문제목

토론자

차상권(한양대 박사)

국가 재무제표의 정보 유용성 증대방안

조형태(홍익대)

김진태(중앙대)

김상노(한길회계법인)

김완희(가천대)

국가회계에 현금흐름표 도입연구

노희천(숭실대)

문창오(조세재정연구원)

김봉환(서울대)

국가회계의 신뢰성 제고를 위한 회계오류의 분석과 개선방안

윤성호(조세재정연구원)

3분과: 재정과 회계의 난제들과 해법

사회자:정창훈(인하대)

URL: https://snu-ac-kr.zoom.us/j/4210144067

발표자

논문제목

토론자

김상노(한길회계법인)

우리나라 인구구조 변화에 따른 국민연금기금 회계처리 개선에 대한

한소영(조세재정연구원)

조광희(동국대)

연구

김이배(덕성여대)

북한 회계제도의 특징과 개선 필요성에 대한 검토

정광화(강원대)

강영기(고려대)

4분과: 회계감사

사회자: 최연식(경희대)

URL: https://snu-ac-kr.zoom.us/j/2801631360

발표자

논문제목

토론자

경영자 과신성향이 파트너 감사시간과 이익조정의 관계에 미치는

김효은(울산대)

조형진(인하대)

영향

김예원(서울대 박사과정)

조미옥(서울대 박사과정)

김수진(영남대

회계법인의 감사실패와 공인회계사의 이탈

박소희(서울대 박사과정)

박사과정)

이우종(서울대)

5분과: 재무회계

사회자: 유용근(고려대)

URL: https://snu-ac-kr.zoom.us/j/9303977335

발표자

논문제목

토론자

Impression Management as a Family Heir? Earnings

안혜성(명지대)

Management by Family CEOs Beyond the Founder

현지원(서울과학기술대)

최승욱(경희대)

Generation

The Effect of Off-Balance-Sheet Disclosure of Operating

김종하(서울대

WANG JIABIN (고려대 석사과정)

Lease on Firm’s Investment Efficiency through Deviated

석사과정)

Financial Ratio

- 4 -

4페이지 본문끝

메뉴

현재 포커스의 아래내용들은 동일한 컨텐츠를 가지고 페이지넘김 효과및 시각적 효과를 제공하는 페이지이므로 스크린리더 사용자는 여기까지만 낭독하시고 위의 페이지이동 링크를 사용하여 다음페이지로 이동하시기 바랍니다.